Fig. 1 Diurnal variation in body temperature, ranging from about 37.5 °C from 10 a.m. to 6 p.m., and falling to about 36.4 °C from 2 a.m. to 6 a.m.

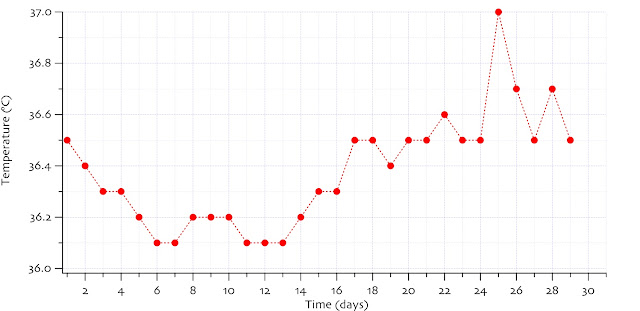

Fig. 2 Example of a basal body temperature chart. Menstruation begins on day 1. The rise in temperature between days 14 and 18 are the indication of ovulation. Temperature was taken orally with a regular fever thermometer. Temperature reading is very sensitive to breaks in the regular sleep-rhythm (e.g. "sleeping in" on day 25 )

Hormonal causes of biphasic patterns

The higher levels of estrogen present during the pre-ovulatory (follicular) phase of the menstrual cycle lower BBTs. The higher levels of progesterone released by the corpus luteum after ovulation raise BBTs. The rise in temperatures can most commonly be seen the day after ovulation, but this varies and BBTs can only be used to estimate ovulation within a three-day range.[4]

If pregnancy does not occur, the disintegration of the corpus luteum causes a drop in BBTs that roughly coincides with the onset of the next menstruation. If pregnancy does occur, the corpus luteum continues to function (and maintain high BBTs) for the first trimester of the pregnancy. After the first trimester, the woman's body temperature drops to her pre-ovulatory normal as the placenta takes over functions previously performed by the corpus luteum.

Very rarely, the corpus luteum may form a cyst. A corpus luteum cyst will cause BBTs to stay elevated and prevent menstruation from occurring until it resolves, which could take weeks or months.

While trying to conceive

Regular menstrual cycles are often taken as evidence that a woman is ovulating normally, and irregular cycles is evidence she is not. However, many women with irregular cycles do ovulate normally, and some with regular cycles are actually anovulatory or have a luteal phase defect. Records of basal body temperature can be used to accurately determine if a woman is ovulating, and if the length of the post-ovulatory (luteal) phase of her menstrual cycle is sufficient to sustain a pregnancy. Some fertility computers and software, such as Lady-Comp, can help a woman to determine these factors. The rise in basal temperature occurs 2–3 days after ovulation. Once it rises, an egg has been released.[5]

Pregnancy tests are not accurate until 2–3 weeks after ovulation. Knowing an estimated date of ovulation can prevent a woman from getting false negative results due to testing too early. Also, 18 consecutive days of elevated temperatures means a woman is almost certainly pregnant.[6]

Tracking basal body temperatures is a more accurate method of estimating gestational age than tracking menstrual periods.[7]

While avoiding pregnancy

Charting of basal body temperatures is used in some methods of fertility awareness, and may be used to determine the onset of post-ovulatory infertility. However, BBTs only show when ovulation has occurred; they do not predict ovulation. Normal sperm life is up to seven to ten days,[8] making prediction of ovulation several days in advance necessary for avoiding pregnancy.

Fig. 3 Menstrual cycle

Source from: Wikipedia